Business Insurance in and around Huntsville

One of Huntsville’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Your Search For Fantastic Small Business Insurance Ends Now.

It's a lot of responsibility to start and run a business, but you don't have to figure it out all on your own. As someone who also runs a business, State Farm agent Christina Smith is aware of the work that it takes and would love to help lift some of the burden. This is coverage you'll definitely want to learn more about.

One of Huntsville’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Cover Your Business Assets

Whether you are a barber a pharmacist, or you own a pet store, State Farm may cover you. After all, we've been doing it for almost 100 years! State Farm agent Christina Smith can help you discover coverage that's right for you and your business. Your business policy can cover things such as money and buildings you own.

At State Farm agent Christina Smith's office, it's our business to help insure yours. Contact our outstanding team to get started today!

Simple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

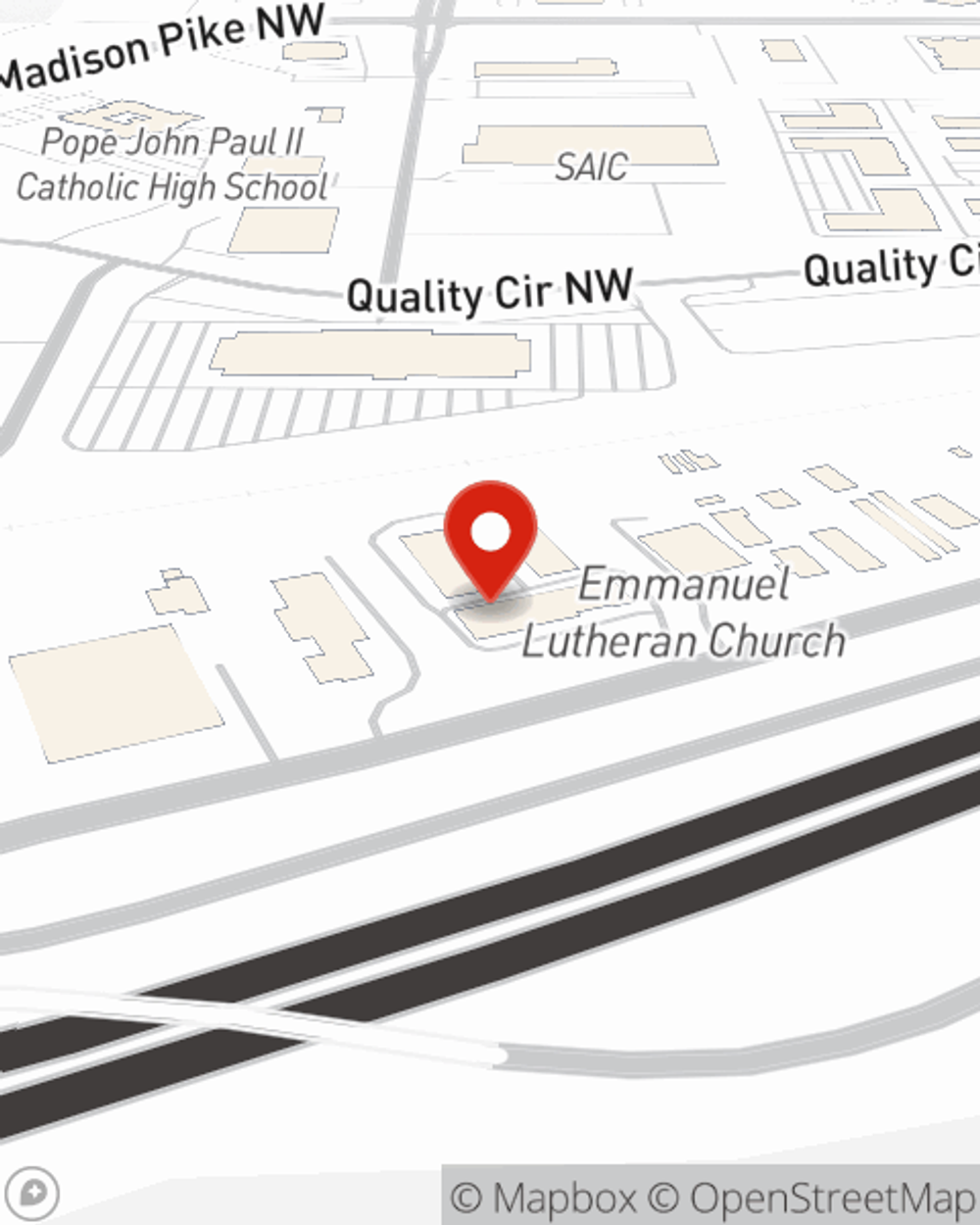

Christina Smith

State Farm® Insurance AgentSimple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.